November 5, 2012

Monty Spivak

Source: www.seekingalpha.com

Monty Spivak

Source: www.seekingalpha.com

Many investors hold at least some gold in their portfolios

as a form of insurance for market, currency, liquidity, or other form of

financial collapse. Gold is a currency substitute, and has a

constrained supply (the only increase is through mining new gold).

Primitive societies, thousands of years ago, recognized this as an

intrinsic store of value, and this has not changed. The value of gold

should increase during times of uncertainty, so a long position should

provide a hedge for a financial or political crisis.

We have

alternative gold investments available. Which type of gold investment

would be most beneficial, and under which circumstance? In order to

facilitate this comparison, I will use the SPDR Gold Shares ETF (GLD) as the basis for all comparisons.

Option 1 - Gold Exchange Traded Funds (aka ETFs)

The

gold ETFs will most closely track the actual price of gold. That said,

there are a lot of "actual prices of gold," which is the reason for the

descriptions. For example, the SPDR Gold Shares ETF (GLD) provide fractional ownership of gold bullion, so would be the one of the best alternative to track the current price.

This table provides the major U.S. gold ETFs for investors to consider for gold exposure and capital gains potential:

| Exchange Traded Funds (ETFs) (Ticker) | Description |

| Goldman Sachs Commodity Index (GSCI) Total Return Index ETF (GSP) | ETN is linked to the S&P GSCI Total Return Index and provides you with exposure to the returns potentially available through an unleveraged investment in the contracts comprising the S&P GSCI plus the Treasury Bill rate of interest that could be earned on funds committed to the trading of the underlying contracts. |

| iShares COMEX Gold Trust ETF (IAU) | The objective of the trust is for the value of the iShares to reflect, at any given time, the price of gold owned by the trust at that time, less the trust's expenses and liabilities. The trust is not actively managed. |

| PowerShares DB Gold Fund ETF (DGL) | Based on the DBIQ Optimum Yield Gold Index Excess Return and managed by DB Commodity Services LLC. The Index is a rules-based index consisting of futures contracts on gold, and is intended to reflect the performance of gold. You cannot invest directly in an Index. |

| SPDR Gold Shares ETF (GLD) | Gold Shares represent fractional, undivided beneficial ownership interests in the Trust, the sole assets of which are gold bullion, and, from time to time, cash. Gold Shares are intended to lower a large number of the barriers preventing investors from using gold as an asset allocation and trading tool. |

These ETFs often have

some cash on their books, or some paper-based gold-holdings (for

liquidity). For this analysis, I have ignored the frictional holdings,

and do not plan to analyze whether it is preferential for a fund to hold

bullion or contract-based gold.

I thought to chart two of the

funds to confirm that the gold ETFs track each other -- and therefore,

represent the price of the underlying commodity (all charts are courtesy of CIBC Investors Edge). We can clearly see that 2 sample ETFs -- DGL and GLD -- move consistently with each other:

(click images to enlarge)

Gold

ETFs would seem to provide an excellent investment alternative to track

the price of gold. For convenience, I will use the SPDR Gold Shares ETF

(GLD) as the

benchmark (sort of a "gold standard") to compare other types of gold

holdings. Given GLD as the basis for all comparisons, let's first expose

a few basic statistics about this ETF, which validates its usefulness from a standpoint of size, liquidity, and expense ratio, and other metrics:

| SPDR Gold | Statistic | Comment |

| Average (Daily) Volume | 8,134,285 | Liquid |

| Recent Price | 162.60 | |

| 52 Week High | 175.46 | Since 11/08/11 (-7.33%) |

| 52 Week Low | 148.27 | Since 12/29/11 (+9.66%) |

| Managed Assets | $72.06 B | Mega-cap |

| Expense Ratio | 0.40% | |

| Average Bid Ask Ratio | 0.01% | |

| Tracking Error | 0.90% | |

| Concentration Risk | 100.00% | Only gold |

The ETFs track the commodity price, so they:

- Do not provide a yield, and as a yield-oriented investor, I would like an alternative.

- Are not a business (which may also be viewed as a strength, as it is not dependent upon management), which provides growth opportunities.

The

next question to answer is whether other gold investments can provide

similar "insurance" -- that they can accurately track the price of gold

-- but provide other benefits, such as yield.

Option 2 - Closed-End Funds (aka CEFs)

Closed-End

Funds (CEFs) can provide investors exposure to gold miners while

providing an income stream. I have identified two of the most common

(and larger-cap) U.S. funds in this space. Both are sponsored by GAMCO.

In addition to Faircourt Gold Income Corp. (FRCGF.PK), there are other Canadian gold CEFs, but they are not traded in the U.S.:

| Company (Ticker) | Yield (%) | Description |

| Faircourt Gold Income Corp. (FRCGF.PK) | 7.1% | Canadian CEF (TSX:FGX): $36M cap; Issued at $9.05/unit, and trading around $8.12 on 2012-10-29; invest in gold exploration, mining or production on the S&P TSX Global Gold Index, while also providing monthly distributions. |

| GAMCO Global Gold Natural Resources & Income Trust (GGN) | 10.0% | The Fund will attempt to achieve its objectives by investing at least 80% of its assets in equity securities of companies principally engaged in the gold industry and the natural resources industries. The Fund will invest at least 25% of its assets in the equity securities of companies principally engaged in the exploration, mining, fabrication, processing, distribution or trading of gold or the financing, managing, controlling or operating of companies engaged in "gold-related" activities. In addition, the Fund will invest at least 25% of its assets in the equity securities of companies principally engaged in the exploration, production or distribution of natural resources, such as gas, oil, paper, food and agriculture, forestry products, metals and minerals as well as related transportation companies and equipment manufacturers. |

| GAMCO Natural Resources, Gold & Income Trust (GNT) | 10.6% | Less gold orientation than GGN. The Fund's primary investment objective is to provide a high level of current income from interest, dividends and option premiums. The Fund's secondary investment objective is to seek capital appreciation consistent with the Fund's strategy and its primary objective. Under normal market conditions, the Fund will attempt to achieve its objectives by investing at least 80% of its assets in securities of companies principally engaged in the natural resources and gold industries. |

In order to determine

the degree to which a Closed-End Fund of gold miners would track the

price of gold, I compared two of the CEFs with the SPDR Gold Shares ETF (GLD).

For clarity, the two bottom lines are the CEFs, and the gold ETF is the

top (performing) line. As well, it is clear that neither the GAMCO

Global Gold Natural Resources & Income Trust (GGN) nor the Faircourt Gold Income Corp. (FRCGF.PK)

track the price of gold in the last two years over this five-year

timeframe. There are certain alignments in some of the peaks and

troughs, but it appears that the CEFs do not provide a direct

correlation to the market price of gold.

We

must conclude that if you are seeking capital gains, rather than yield,

and want to track gold prices more directly, then the Closed-End Fund

alternative is probably NOT your best choice. You should probably be

holding a gold bullion ETF or mutual fund. Otherwise, CEFs offer the

only very high yield for gold holdings, which perhaps compensates for

the price difference of the commodity.

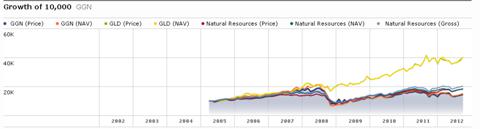

I also examined the total return of GAMCO Global Gold Natural Resources & Income Trust (GGN) using Morningstar's Performance (Total Returns) graph,

which reports the cumulative value of $10k invested, including

distributions. With its 10% yield, this Closed-End Fund provides the

investor with a substantial total return -- which is an upward-sloping

line, Price alone (which plummeted in both this and the previous chart)

-- does not indicate the total return. Despite the difference, which is a

better recovery for the CEF total return, the gold-tracking SPDR Gold

Shares ETF (GLD) remains the top line.

There

is one important caveat -- the CEFs with managed distributions (such as

the three examples in the table) often rely upon the return of capital to fund the distributions -- several SA articles (another example)

and reader comments explore this issue in detail and explain the

trade-offs. This may influence your perception of the benefits of the

gold-miner CEF alternative.

Option 3 - Gold Mining Companies

I have assembled a sample of large and mid-cap gold producers that are represented in many of the gold-mining funds.

| Company (Ticker) | Yield (%) | Description |

| Agnico-Eagle Mines (AEM) | 1.6% | Canadian-based gold producer with operations in Canada, Finland and Mexico, and exploration and development activities in Canada, Finland, Mexico and the U.S. |

| Anglogold Ashanti (AU) | 1.7% | AngloGold Limited is the largest gold producer at 7 million ounces a year, with reserves of 126 m oz. The company has operations in six countries on three continents, some of which are joint ventures, as well as exploration activities in 10 countries. |

| Barrick Gold (ABX) | 2.0% | Barrick Gold Corporation is a leading international gold producer with low-cost mines in North and South America. |

| Gold Fields Ltd. (GFI) | 4.0% | Gold Fields Limited is one of the world's largest unhedged gold producers with operating mines in South Africa, Ghana, and Australia. |

| Goldcorp (GG) | 1.2% | Goldcorp is a North American-based gold producer engaged in exploration, extraction, and processing of gold. The company's primary asset and key value driver is its Red Lake Mine, which is the largest producing gold mine in Canada. |

| Gold Resource Corp. (GORO) | 3.6% | The Company has 100% interest in four potential high-grade gold and silver properties in Mexico's southern state of Oaxaca. |

| Iamgold (IAG) | 1.6% | It holds a 38% stake in the Sadiola Gold Mine and a 40% stake in the Yatela Gold Mine. Both are located in Mali, West Africa. |

| Kinross Gold (KGC) | 1.6% | The Company's mines are located in the regions of South America, North America, West Africa and Russia. |

| Randgold Resources (GOLD) | 0.3% | It has to date discovered the 7 Moz Morila deposit in southern Mali, the plus 5 Moz Yalea deposit in western Mali and the 3 Moz Tongon deposit in the Cote d'Ivoire. It has a portfolio of prospective exploration projects across Africa in Mali, Cote d'Ivoire, Senegal, Burkina Faso, Ghana and Tanzania. |

| Semafo Inc. (SEMFF.PK) TSX:SMF | 1.0% | A mining company with gold production and exploration activities in West Africa. The Company operates three gold mines: the Mana Mine in Burkina Faso, the Samira Hill Mine in Niger and the Kiniero Mine in Guinea. |

| Yamana Gold Inc. (AUY) | 1.4% | Yamana Gold is a Canadian gold producer with significant gold production, gold and copper-gold development stage properties, exploration properties and land positions in all major mineral areas in Brazil. |

One

general heads-up about mining stocks -- despite their U.S. and Canadian

listings, many have operations in Africa and South America -- and some

of these countries have unstable political environments, and/or regimes

that are unfriendly to mining companies. Therefore, we need to recognize

that for these, there are risk trade-offs in exchange for potentially

greater (yield and capital gains) returns.

My previous articles -- "Hedge For Inflation And Deflation With Precious Metals Convertible Securities - Part 1 - U.S. Securities" and "Hedge For Inflation And Deflation With Precious Metals Convertible Securities - Part 2

- Canadian Securities" -- propose that investors employ precious metals

convertible preferred shares and debt, in order to provide yield with

gold exposure. This is my alternative because few gold mining companies

pay dividends, and most of those that do pay a "whopping" dividend of

less than 2%.

Will a gold miner, or a convertible bond of a gold

miner, align with the price of bullion -- as tracked by the SPDR Gold

Shares ETF (GLD)? I used Goldcorp (GG) -- the largest gold miner, and New Gold's (NGD) convertible debenture (TSX: NGD.DB), one of the largest gold convertibles in the marketplace -- as representative securities:

Again,

the gold-tracking ETF is the top line. Goldcorp (the bottom line) seems

to have a rough alignment with the market movement of gold prices, but

there are differences. Perhaps it is just my interpretation, but the

gold-miner seems to have deeper troughs and lower highs than the

commodity ETF.

Although some of the gold-commodity spikes seem to briefly lift the prices of the New Gold (NGD)

convertible security, it does seem to be sticky around its long-term

price (of $120 per $100 face value), which provide a strong support

level. Perhaps one can generalize this, and suggest that there is some

price appreciation with the increase of gold prices, and that

price-drops are mitigated by the fixed-income nature of the convertible

instrument. Overall, convertible prices are less volatile, and are not

closely correlated with the price of gold. Again, the yield compensates

the holder of a convertible bond, and the ability to convert the debt

into gold-miner equity can provide a gold-like hedge -- at least it

should as the redemption/conversion date approaches.

The big

challenge of using gold miners as a proxy for the price of gold bullion

is that the performance of the company is perhaps as great, or greater, a

driver of the share price, as the price of gold. For example, Kinross

Gold (KGC) has

had a string of unsuccessful mining projects and a stock-price

meltdown. The conclusion is that one must expect variability of a

gold-miner's share price with the miner's profitability -- not simply

the market price of gold (or anticipated market price of gold). Again,

GLD, the gold-tracking ETF, is the top line; Goldcorp (GG) the middle; and Kinross (KGC) the lower line:

The

conclusion that we can draw is that individual gold-miner results trump

the market price of gold; although if a miner is performing relatively

well (such as Goldcorp), it may approximately trend with the gold

commodity.

Comparing the Alternatives

The

last step is to compare all three gold investment options. Given the

very different nature of the three gold investment options, one would

expect some divergence in their graphs.

There is no surprise here.

The graph compares how one representative gold miner (Goldcorp - GG -

pink) tracks against one CEF (GGN - the bottom line) and the SPDR Gold

Shares ETF (GLD - the top line):

Clearly,

there are other factors than simply the market price of gold

(represented by the GLD ETF) that determine the market price for the

gold miner and the CEF. Of course, the CEF and miner trend-lines exclude

the return associated with their yields, which again, in the case of

GGN, is substantial (10% per year).

I have not explored these alternatives, although they may be viable and cost-effective for some investors:

- Directly purchasing gold ingots and coins and holding them in a safety deposit box (or the bank acting as custodian of this asset type for you). I have tried this with silver in the past. This is complex and expensive to do for small holdings, subject to retail margins on the transactions, and not as liquid or convenient as holding securities.

- Mutual funds with gold holdings (or gold miner holdings) are available to investors, but the additional fees (particularly in Canada, where fees are often 2% - 3%) make this a less attractive alternative to many investors.

- To generate income, it is possible to sell options on many of the gold funds and mining companies. In one of my long-ago articles about gold, a reader, Smarty_Pants, provided an excellent comment on how to use options to generate yield. I recognize that this is potentially remunerative, but have not identified a mechanism to value a string of puts and calls (and possibly have the options exercised).

The matrix, below, can help you decide which of the three options best meet your investment goals:

| Option/Attribute | Option 1 - Gold ETFs | Option 2 - Gold CEFs | Option 3 - Gold Mining |

| Description | Holds gold (and may hold gold options) | Portfolio of gold miners | Individual mining co. |

| Advantages | Tracks gold and/or future contracts Has outperformed other alternatives | Can pay high (managed) distributions | Return based on business and margin of gold mining |

| Disadvantages | No yield | May vary indirectly with the price of gold -- there are other factors (such as non-gold holdings) impacting the security price | Management decisions, local jurisdictions, and other factors may have a bigger impact than gold price |

We

must conclude that the choice of gold investment depends on your

investment goals, but the consistent five-year top performer is a gold

bullion ETF -- in this case, SPDR Gold Shares ETF (GLD).

I

would like to make one last disclaimer. My sample size is small -- I

have generally provided one example from each of the categories,

although I did model more than one when testing my hypotheses. If you

are wondering how your favorite mining company or CEF behaves against

the fluctuations in the price of gold, there are many websites that

facilitate this comparison. My request is that if you learn anything

that relates to this, perhaps you can share it?

For disclosure,

most of my holdings in this sector are not traded in the U.S.

Personally, as a yield-oriented investor, I have chosen Options 2 and 3

(via convertible securities) for my gold holdings. That said, it is

clearly not the best choice when benchmarked against GLD.

No comments:

Post a Comment